Misrepresentation over cost is cited, like the nuclear waste issue, as a reason to say “No” to the nuclear option. Yet, short-term, politically-motivated price incentives for energy sources that don’t add value have forced energy prices to a point where the UK is now experiencing high inflation and hence a ‘cost of living crisis’.

Cost and value in energy debates should be recognised as separate issues – where ‘value’ measures worth, including any foreseeable externalities, whereas ‘cost’ considers only the short-range outgoings necessary to accumulate the desired material/service. i.e. Energy return on investment (EROI) ought to be a more useful long-term measure for decision makers than, say, the Levelized cost of electricity (LCOE).

People complain about the high upfront costs of nuclear, but in reality, for example to build 3GW capacity at Sizewell C means an extra £1 per month is needed to be added to consumer bills.

UK Policy Impacts & New Build financing

Through its Electricity Market Reform (EMR), the UK government has essentially agreed to regulate a liberalised energy market.

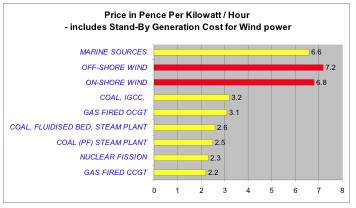

Under this, a ‘Contracts for Difference’ scheme was enacted to provide long-term price stabilisation to low carbon plant, allowing investment to come forward at a lower cost of capital and therefore at a lower cost to consumers. However not all low carbon energy options are as worthy of investment as each other as we can see below.

This image (courtesy of Department for Energy and Climate Change) shows the relative costs of each low carbon generating electricity for each technology, based on a value-based contractual ‘strike price’ – that is the price fixed between the UK and tendering company to build (in MW/h).

In October 2013, the Government agreed to a new nuclear ‘strike price’ with Electricité de France (EdF) for Hinkley Point C. The key terms include 35-year price for power of £89.50 /MWh from about 2023, fully indexed to the Consumer Price Index and conditional upon Sizewell C project proceeding. (If it does not for any reason, and the developer cannot share first-of-a-kind costs across both, the price is to be £92.50 /MWh.)

New build nuclear power station pricing includes future costs such as decommissioning, clean-up and radioactive waste storage as well as the high capital and costs for the site.

- Nuclear reactors or sited on coastal locations around the UK and are generally large and complex, with lots of reinforced concrete and nuclear-grade quality assurance programs. As a result they tend to be expensive to build (see image capital costs, below).

- Once built, fuel and operating costs are relatively cheap. E.g. One kilogram of uranium will yield about 20,000 times as much energy as the same amount of coal. Also, fuel costs aren’t linked to volatile gas and oil market forces.

- Return on investment from large nuclear plants, such as Hinkley Point C in the UK have an increasing potential to be more significant than those from gas, despite over-regulation, public opposition and high interest rates which can obstruct progress [1].

Data received courtesy of a report by The Royal Academy of Engineering in association with PB Power supports the claim that nuclear is competitive with other forms of electricity generation. Capital costs are greater than those for fossil fuel-fired power stations, but running costs and the cost of fuel are considerably less.

Key

- OCGT open cycle gas turbine

- CCGT closed cycle gas turbine

- ICGT integrated gasification combined cycle

- PF pulverised fuel

As well as the two large scale commissions on nuclear licensed sites, namely Hinkley Point C and Sizewell C in the UK, there is optimism towards the use of localised ‘Generation IV’ small modular reactors.

On 01 November 2021, the UK Government introduced a Nuclear Energy (Financing) Bill 2021-22, which sets out a framework to encourage free market investments, using the Regulated Asset Base Model.

By making a clear commitment, overall costs can be reduced. Public confidence in a fleet of similarly designed reactors is the most effective way to dispatch low carbon energy to meet demand pitched by Friends of Nuclear Energy (FoNE) to bankers in the City of London in order to encourage nuclear energy inclusion in their Environmental, Social and Governance (ESG) Funds.

Other materials:

World Nuclear News Symposium: Financing nuclear projects

World Nuclear Association: Financing Nuclear Energy

The Future of Nuclear Power – the Role of Nuclear power in a low Carbon Economy– a report by the UK’s DTI, although from 2007, provides a good source of information concerning nuclear technology and costing strategies.

Kirsty Gogan of Lucid Catalyst presents to an American Audience (2019) The Potential for Nuclear Cost reduction

World Nuclear News on financing models

Capital Costs

Capital Costs Operating Costs

Operating Costs

Leave a Reply

You must be logged in to post a comment.